what is a open end signature loan

A closed-end loan is often an installment loan in which the loan is issued for a specific amount that is repaid in installment payments on a set schedule. Generally speaking there are two primary forms of loans offered to individuals today those being open-end and closed-end loans.

Personal Loans And Lines Of Credit Sesloc Federal Credit Union

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to.

. The biggest example of this type of loan is a credit card. It provides a fixed rate for a. A signature loan is an unsecured loan you can take out simply by providing a lender with your income credit history and signature.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Whereas an open-end loan allows. A line of credit is a type of open-end credit.

Also called a good faith or character loan you can qualify. Rates for the Visa Signature Visa. An open-ended loan is one that allows you to continue borrowing funds that are paid back on an ongoing basis.

A signature loan is an unsecured loan you can take out simply by providing a lender with your income credit history and signature. Open-End Signature Loans With unlimited access to your credit line through real-time loan advances 1 our variable-rate 2 Open-End Signature loan is one of our most flexible finance. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain.

An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before. Signature loans do not require collateral to secure the loan making them different from auto loans home loans and other secured loans. Also known as a good faith or character loan a signature loan is a type of unsecured personal credit offered by banks and credit unions.

A signature loan is an unsecured loan. Also called a good faith or character loan you can qualify. The term signature loan indicates that this type of loan is based on your signature alone and no collateral is required while secured loans may require that you provide collateral such as a.

What Is a Signature Loan. Unsecured Signature Loan Elements Financial. An example of this is an auto loan.

Documents required for individuals.

/loan_86800398-5c477b1146e0fb0001db7364.jpg)

Signature Loan A Popular Type Of Unsecured Loan

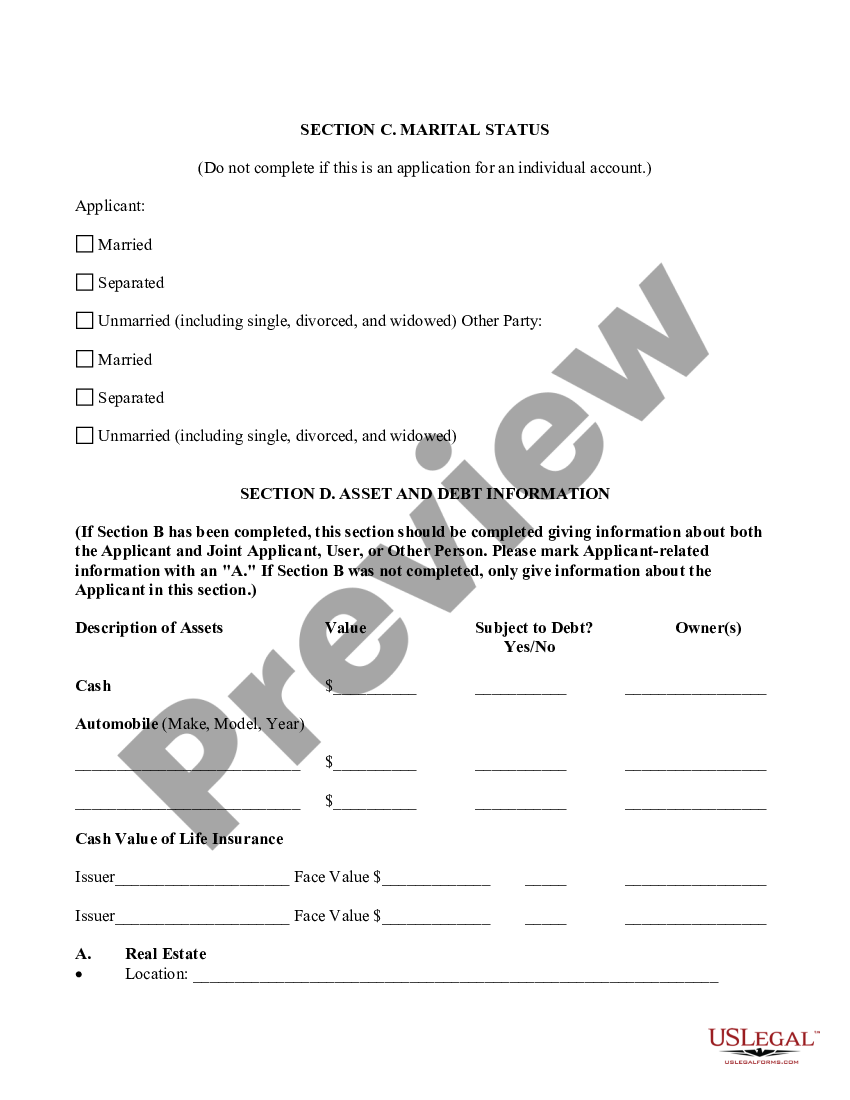

Application For Open End Unsecured Credit Signature Loan Us Legal Forms

Signature Loan Guide Key Things To Know In 2022

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Bad Credit Loans Online Quick Cash Instaloan

Signature Loan Guide Key Things To Know In 2022

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)

Loan Vs Line Of Credit What S The Difference

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

5 Signature Loans With No Credit Check 2022 Badcredit Org

Money Market Share Account Lgfcu

Online Loans Bad Credit Loans Online In Nh Ut Ks Wi Id De Tn Mi Co Online Personal Loans With Poor Credit

What Are Signature Loans Sign Here Loanry

A Guide To Signature Loans Personal Loans Lendingtree

What Is A Signature Loan Pros Cons Lantern By Sofi

Online Loans Bad Credit Loans Online In Nh Ut Ks Wi Id De Tn Mi Co Online Personal Loans With Poor Credit

Federal Register Regulation Z Truth In Lending